- Home

- About

- Rates

- Calculator

- Loan Programs

- Down Payment Assistance

- FHA Loans

- Conventional Loans

- VA Loans

- Jumbo Loan

- DSCR Loans

- Self-Employed Loans

- Second Mortgages

- P&L Loans

- HELOC Loans

- Bank Statement Loans

- Reno/Rehab Loans

- Reverse Mortgages

- USDA Loans

- Construction Loans

- Debt Consolidations Loan

- Investor Loans

- Equity Builder Rapid Payoff Loan

- Doctor Loans

- Teacher Loans

- Law Enforcement Loans

- Resources

- News

Low Rates.

Easy Applications.

Quick Closings.

Our rates are low, our application is quick and easy! We can get you clear to close in as little as 10 days!

Loans available nationwide.

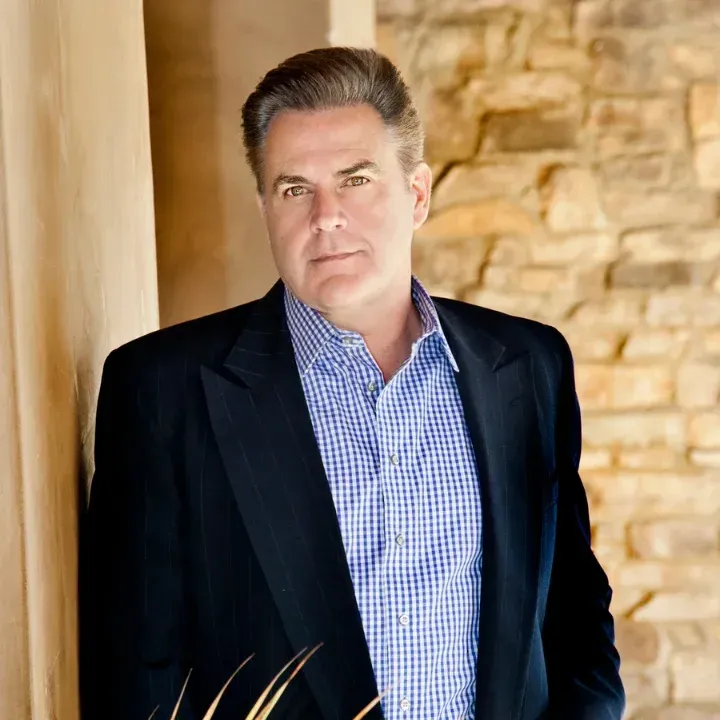

I'm Rodney Rose, from E Mortgage Capital and I'm excited to help you obtain the perfect home loan for you.

Loan officer

NMLS#: 1396861

DRE#: 00853403

Contact Details

Quick Actions

Trusted By Agents With

mortgage loans Nationwide

Low Rates.

Easy Applications.

Quick Closings.

Our rates are low, our application is quick and easy! We can get you clear to close in as little as 10 days!

I'm Rodney Rose, from E Mortgage Capital and I'm excited to help you obtain the perfect home loan for you.

“Let MY Experience Make

YOUR Experience GREAT!”

About

Rodney Rose

Your Trusted Partner in Mortgage Lending

His mission is to guide you toward the best loan program and rate tailored to your unique needs. The Promise: Rodney’s promise to you includes: A loan solution for every home. Expert strategies to overcome complex issues. Low rates and fees. A focus on integrity and trust.

Loan Officer/Branch Manager

NMLS#: 1396861

DRE#: 00853403

Contact Details

Contact Rodney Today!

A Big Diverse Mortgage Portfolio

Rodney’s expertise spans various loan types, including Purchase, Refinance, Cash-Out, Debt Consolidation, Down Payment Assistance, and more. Whether you’re seeking a Conventional, FHA, VA, Jumbo, or Investment loan, Rodney has you covered. People First, Transactions Second: Rodney believes that success is measured by lasting relationships. With personal attention and expert advice, he’ll guide you through the loan process, ensuring your goals are met with peace of mind. Contact Rodney: Let Rodney’s comprehensive background in Mortgage, Title & Escrow, Appraisal, Real Estate Sales, Construction, Investments, and Lending pave the way for a smooth and successful transaction. Reach out today! Fun Fact: When Rodney isn’t navigating mortgages, he’s coaching his kids’ baseball, softball, and basketball teams. His love for sports and family shines through in all he does. 🏀⚾🐶🐱

Mortgage Loan Programs

"A Loan for every Home"

Down Payment Assistance

Down Payment Assistance can help you get up to $100,000 toward your home purchase.

FHA Loans

FHA loans are government-backed mortgages that make homeownership more accessible and affordable.

Conventional Loans

Conventional loans are mortgages offered by private lenders without government insurance or backing.

VA Loans

VA loans provide key benefits over conventional mortgages, making them ideal for eligible veterans and service members.

Jumbo Loans

Jumbo loans offer greater borrowing power and flexibility for financing high-value or luxury properties

USDA Loans

A USDA Loan is a government-backed mortgage offered through the USDA Rural Development Guaranteed Housing Loan Program.

Reverse Mortgage

Specialized home loans for homeowners 62 and older that convert home equity into cash with no monthly mortgage payments required.

DSCR Loans

DSCR loans are ideal for real estate investors, focusing on property income rather than personal income to qualify.

Self-Employed Loan

Our self-employed mortgage options are tailored to help business owners overcome income verification challenges and qualify for home loans.

Profit and Loss statement loans help self-employed individuals and business owners qualify for mortgages using their business income.

HELOC Loans

Access your home equity with a flexible line of credit—borrow what you need, when you need it.

Bank Statement Loans

Bank statement loans allow self-employed borrowers and business owners to qualify for mortgages without traditional income documentation.

Reno/Rehab Loans

Finance your home purchase and renovation with one loan based on the property's future improved value.

Second Mortgages

Access your home’s equity with a fixed-rate second mortgage—without changing your existing first mortgage.

Construction Loans

Build your dream home with flexible construction financing tailored for ground-up projects.

Debt Consolidation Loan

Simplify your finances by combining multiple debts into one manageable payment with lower interest and flexible repayment options.

Investor Loans

Empower your investment goals with financing designed for property investors—flexible terms, higher limits, and fast approvals.

Equity Builder Rapid Payoff Loan

Build home equity faster and reduce total interest costs with our rapid payoff loan designed for long-term savings.

Doctor Loan

Exclusive mortgage solutions for medical professionals offering low down payments, flexible underwriting, and no PMI requirements.

Teacher Loan

Affordable home financing options for educators with low down payments, flexible credit standards, and special assistance programs.

Law Enforcement Loan

Special mortgage benefits for police officers and first responders with low rates, reduced fees, and flexible qualification options.

Our Process

How to Qualify for a Mortgage Loan

Our comprehensive process ensures a seamless journey from initial consultation to successful loan approval. Experience personalized guidance and expert support every step of the way.

Rodney's Advantage

How Rodney stands out

He strives to offer unparalleled service to our borrowers. This includes a lean and simple process, a dedicated loan officer who can offer different customizable loan options with very attractive payment terms.

15-minute loan approvals

FICO options down to 500

Non-QM & No income options

Flex rate options

Access to multiple lenders and investors

Reverse & Reverse Jumbo options

Access to Down Payment

Assistance programs

Bank Statement

Loan options

Vesting Choices

Commons ways to take ownership title

| Tenancy in Common | Joint Tenancy | Community Property | Community Property with Right of Survivorship | |

|---|---|---|---|---|

| Parties involved | Two or more persons1 | Two or more natural persons | Spouses or domestic partners2 | Spouses or domestic partners2 |

| Division | Ownership can be divided into any number of interests, equal or unequal | Ownership interests must be equal | Ownership interests must be equal | Ownership interests must be equal |

| Creation | One or more conveyances (law presumes interests are equal if not otherwise specified) | Single conveyances (creating identical interests); vesting must specify joint tenancy | Presumption from marriage or domestic partnership or can be designated in deed | Single conveyance and spouses or domestic partners must indicate consent which can be on deed |

| Possession and control | Equal | Equal | Equal | Equal |

| Transferability | Each co-owner may transfer or mortgage their interest separately | Each co-owner may transfer his/her interest separately but tenancy in common results | Both spouses or domestic partners must consent to transfer or mortgage | Both spouses or domestic partners must consent to transfer or mortgage |

| Liens against one owner | Unless married or domestic partners, co-owner's interest not subject to liens of other debtor/owner but forced sale can occur | Co-owner's interest not subject to liens of other debtor/owner but forced sale can occur if prior to co-owner's/debtor's death | Entire property may be subject to forced sale to satisfy debt of either spouse or domestic partner | Entire property subject to forced sale to satisfy debt of either spouse or domestic partner |

| Death of co-owner | Decedent's interest passes to his/her devisees or heirs by will or intestacy | Decedent's interest automatically passes to surviving joint tenant ("Right of Survivorship") | Decedent's 1/2 interest passes to surviving spouse or domestic partner unless otherwise devised by will | Decedent's 1/2 interest automatically passes to surviving spouse or domestic partner due to right of survivorship |

| Possible advantages/disadvantages | Co-owners interests may be separately transferable3 | Right of Survivorship (avoids probate); may have tax disadvantages for spouses | Qualified survivorship rights; mutual consent required for transfer; surviving spouse or domestic partner may have tax advantage2 | Right of survivorship; mutual consent required for transfer; surviving spouse or domestic partner may have tax advantage |

Roll Your Way to Homeownership!

Experience the journey from loan application to closing in a fun,

interactive board game — one dice roll at a time.

Play Instructions

Click the dice to roll 1–6. The token advances that many steps.

Current Step

Start

Dice: —

Get Your Giant Credit Card

to go Home Shopping

Join the debate!

Why do Clients LOVE Rodney? Is it his GREAT SERVICE or Is it his LOW RATES?

Great Service!

- Decades of mortgage & real estate expertise

- Tailored loan programs for your needs

- Award-winning client satisfaction

- Licensed in Mortgage, Real Estate, and Appraising

- Focused on lifelong client relationships

Low Rates!

- Generic, one-size-fits-all options

- Minimal guidance beyond numbers

- Service often cut for lower fees

- Overlooked opportunities & mistakes

- Quick turnaround over satisfaction

Testimonials

What our clients are saying about us